Development of technical provisions

Pension components placed into funds for private-sector employees constitute pension providers’ technical provisions to future pensioners. We compile statistics on the development of technical provisions and update the accompanying figures once a year, in October-November.

Content of this page

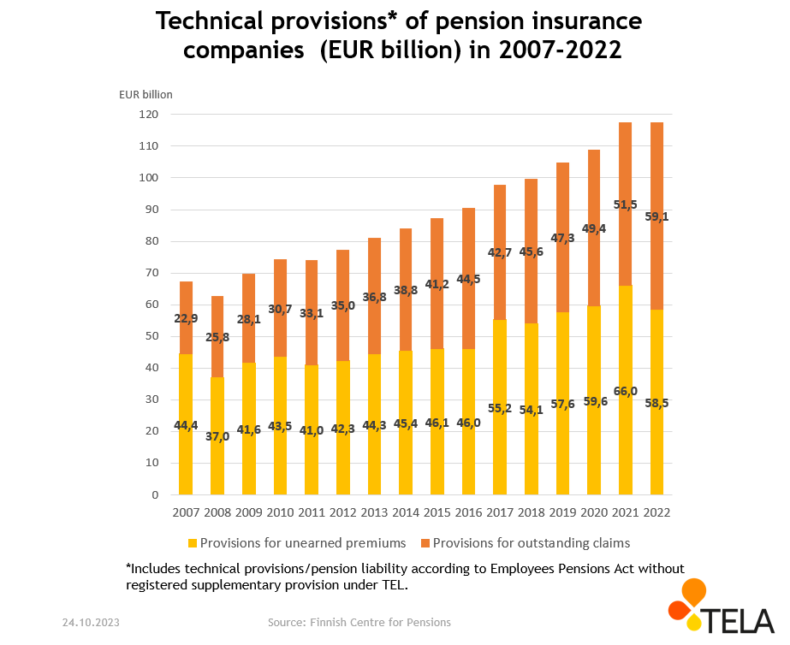

Technical provisions of pension insurance companies

At the end of 2022, pension insurance companies’ technical provisions totalled EUR 117.6 billion. The amount of technical provisions has increased fairly steadily since 2007 (when compilation of the statistics began).

About half of technical provisions, i.e. EUR 58.5 billion, was provision for unearned premiums The provision for unearned premiums consists mainly of components funded for future pension events (old-age and disability pensions). The remaining assets, or EUR 59.1 billion, were provisions for outstanding claims funded for pensions already being paid.

Technical provisions do not include the share of TEL supplementary pension insurance. Prior to 2001, the employer had the option of taking out a registered supplementary pension insurance for employees in order to supplement the low level of pensions in the early stages of the statutory pension system. TEL supplementary pension insurance was terminated at the end of 2016, but there are still employees in working life who have accumulated a supplementary pension that awaits their retirement.

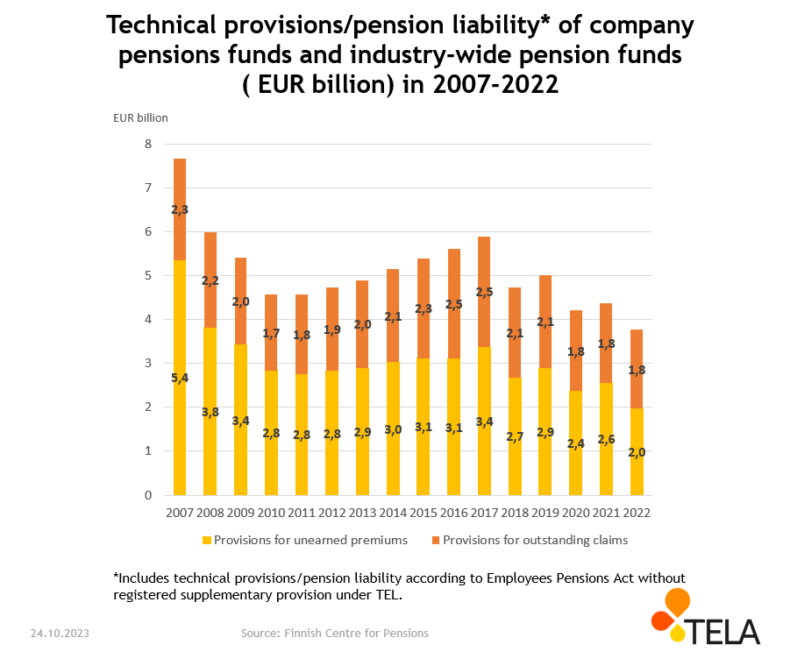

Technical provisions/pension liability of company pension funds and industry-wide pension funds

The technical provisions/pension liability of company pension funds and industry-wide pension funds together accounted for EUR 3.8 billion at the end of 2022. The amount of technical provisions/pension liability first decreased in the period under review, which began in 2007, but it has increased slightly since then. However, it should be noted that the amount of technical provisions/pension liability also depends on the decrease in the number of company pension funds, which stems from the mergers of company pension funds with pension insurance companies.

Of the total sum, EUR 2.0 billion was provision for unearned premiums. This means assets placed into funds for old-age and disability pensions, which will start in the future. The rest, or EUR 1.8 billion, was assets funded for pensions that had already begun, i.e. provisions for outstanding claims.

As in the statistics on the technical provisions of pension insurance companies, the technical provisions/pension liability of company pension funds and industry-wide funds do not include the share of TEL supplementary pension cover.