Factors affecting the sustainable financing of earnings-related pensions

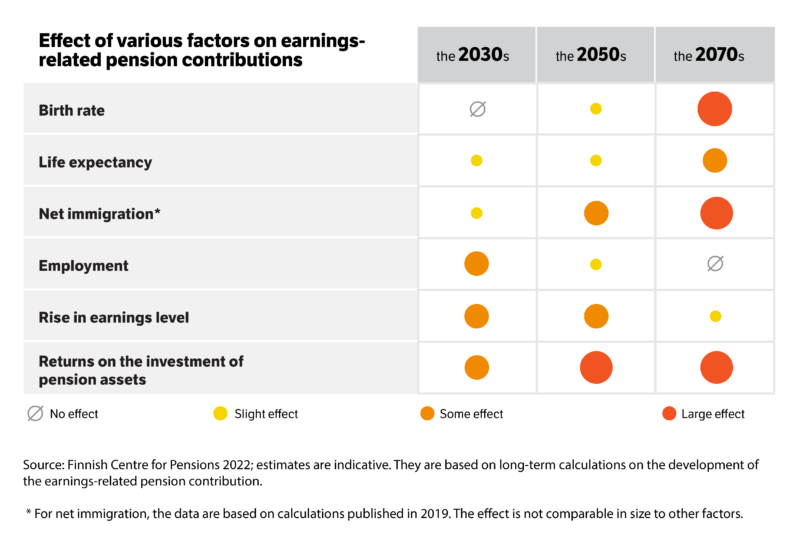

Many factors — such as the birth rate, employment, and returns on the investment of pension assets — underlie the financing of earnings-related pensions. Some factors are more relevant to the sustainable financing of earnings-related pensions and have a faster and more straightforward impact than others.

Content of this page

The weight of different factors varies over decades

Many different factors affect the sustainable financing of earnings-related pensions:

- birth rate

- life expectancy

- net immigration

- employment

- increase of wages

- returns on the investment of pension assets.

These different factors are often interdependent: when one factor changes, it has an impact on others as well. Some factors carry more weight than others and have an effect over very different time spans.

For example, changes in employment are manifested quickly: if employment improves, more earnings-related pension contributions can be collected at the same contribution level. On the other hand, improved employment also means an increase in accrued pensions, i.e. more pension entitlements will accrue for the future. In this case, more assets will also be needed in the future to pay for earnings-related pensions. In the long run, employment has no effect on the financial position of earnings-related pensions.

If economic growth is strong, good investment returns will also be obtained for earnings-related pension assets. They support the financing of pensions both now and especially in the future. The impact will be felt after several decades as present-day middle-aged people retire on old-age pension.

Pressure on the pension contribution as an indicator

When assessing the importance of various factors to the financing of earnings-related pensions, the infographics use the pension contribution as the indicator. The factor’s impact on the contribution shows how developments in that particular factor increase or relieve pressure on the level of earnings-related contributions. The basic and sensitivity calculations of the Finnish Centre for Pensions concerning the financing of earnings-related pensions are in the background.

Demographic trends play a decisive role

The basis for financing earnings-related pensions is the working population: earnings-related pensions are mainly financed by pension contributions, which are collected from employed and self-employed workers and employers. The size and earnings of the working population largely determine how much money can be collected to pay for earnings-related pensions. The rest of the annual earnings-related pensions is paid out of funded pension assets and their investment income.

Demographic development thus plays a crucial role in the amount of labour available in work life at any given time. The number of working-age people depends on the birth rate, life expectancy and net immigration. The impact of these factors differs in the short and long term. These factors can also be influenced by measures taken at different levels of society and politics.

Decreased birth rates reduce the number of payers

Birth rates in Finland declined rapidly in the 2010s. Low birth rates and longer life expectancy lead to a steady decline in the proportion of children and working-age people in the population, while the proportion of pensioners is rising.

When the earnings-related pension system was established in the early 1960s, there were eight times as many workers as there were retirees at that time. In the mid-2010s, there were only three times as many workers. The number is projected to fall to two in the early 2040s. It is predicted that, by 2070, the working-age population will be only 1.5 times that of retirees.

Low birth rates pose a challenge to the financing of earnings-related pensions, as the number of working-age groups, and thus the number of people paying pension contributions, decreases. The effects are visible over a long period of time.

When life expectancy increases, pensions are also paid for a longer time

Finns’ life expectancy has increased rapidly over the last few decades. The life expectancy of a 65-year-old man in 1990 was just shy of 14 years, and that of a woman almost 18 years. In 2021, the equivalent life expectancy at 65 was 18.5 years for a man and 21.9 years for a woman.

The older a person lives, the longer he or she is paid a pension. Thus, as life expectancy has increased, the average payment period for pensions has also increased. The pension reforms that came into force in 2005 and 2017 have responded to the increase in life expectancy both by raising the retirement age and by introducing a life expectancy coefficient that limits the increase in pension expenditure due to longer life expectancy and encourages people to continue working.

Net immigration increases the size of the working-age population

Immigration to Finland has increased since the 1990s. Typically, most immigrants are younger working-age people as well as children. The more new residents move to Finland compared to the number who have emigrated to other countries, the higher the net immigration remains.

Net immigration is reflected immediately in the working-age population, in contrast to the birth rate, where changes have a time lag. The increase in net immigration and the employment of immigrants will relieve the upward pressure on earnings-related pension contributions.

Employment and investment returns in a growing role

The more people are employed, the more earnings-related pension contributions accrue

Employment includes both the number of working-age people and the employment rate. The more people there are in working life, the wider the funding base for earnings-related pensions will be, since earnings-related pensions are financed mainly by contributions collected from wages and salaries. In the long run, earnings-related pension contributions account for about three-quarters of annual pensions, and the rest is paid out of pension funds and their investment returns.

Economic trends and the employment rate play a major role in the financing of earnings-related pensions in the short and medium terms. A high employment rate lowers the pressure on earnings-related pension contributions because there are many payers. If the employment rate falls, the opposite could happen. In practice, however, the goal has been to keep the level of pension contributions stable. In the long run, the impact of employment changes is neutral, as increasing employment also leads to new pension entitlements, i.e. pensions to be paid in the future.

The employment rate can be improved by various means, such as prolonging careers, involving people with partial work ability in work life, and through various flexibilities, such as better opportunities for part-time work.

High employment is important, especially for the adequate level of pensions. The longer the career, the better the earnings-related pension. Correspondingly, if the career is very short or intermittent, the accrued earnings-related pension will be smaller.

An increase in wages also increases the amount of funds collected through earnings-related pension contributions

As wages rise rapidly, income from earnings-related pension contributions also rises. This in turn reduces upward pressure on earnings-related pension contributions. On the other hand, rising wages also increase accrued pensions. If wage growth is non-existent, the opposite will be true.

Increasing wage level also affects pension expenditure. Pensions in payment are raised annually by the earnings-related pension index, which takes into account the development of both prices and wages: the change in prices accounts for 80 per cent and the change in wage levels for 20 per cent.

Because of indexation, rapid wage growth raises earnings-related pensions in payment less than it raises the wage level. Similarly, if wages grow slowly, pensions will rise more in relation to wages.

Investment assets will be increasingly important for the financing of earnings-related pensions

Pension contributions alone are not enough to cover earnings-related pension expenses. However, there has been no need to increase contributions as much as pension expenditure has risen, as the funded pension assets and their returns cover part of the annual pensions.

Returns from pension assets play a key role in the long-term development of earnings-related pension contributions. The more assets there are, the more it is possible to increase their share in the financing of earnings-related pensions.

The average real return on investments has been just over 4 per cent since 1997. However, past returns are not a guarantee of future returns. Due to low interest rate expectations, the basic assumption for investment returns in the long-term sustainability calculations updated by the Finnish Centre for Pensions in 2021 is 2.5 per cent until 2031. Thereafter, returns are assumed to be 3.5 per cent per year.

If the long-term return were higher than expected, it would reduce the upward pressure on earnings-related pension contributions. And vice versa: a weaker-than-expected return would increase the pressure to raise the contribution.