Earnings-related pensions as an element of social insurance

Social insurance is the statutory and compulsory insurance provided by the public authorities against social risks, such as old age, illness or accidents at work, disability, unemployment, or the death of the family’s breadwinner. It consists of sickness, unemployment, accident and pension insurance as well as group life insurance for employees.

Social insurance is mainly financed by collecting insurance premiums from the insured or their employers. This is in contrast to the last-resort social assistance and social benefits, which are covered by tax revenue.

Content of this page

Whole picture of Finnish pension insurance

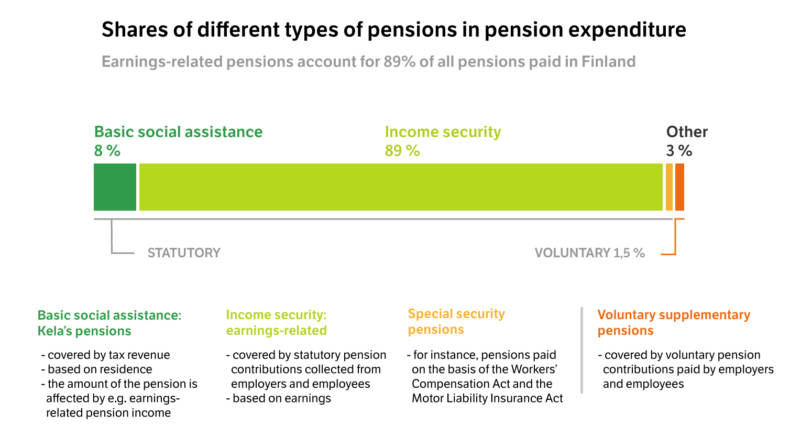

In Finland, pensions are mainly a benefit included in social insurance. They consist of two statutory elements: earnings-related pension, determined on the basis of earnings over the whole career; and a residence-based national pension independent of the person’s career.

Pensions can also be paid on the basis of the Workers’ Compensation Act, the Occupational Diseases Act and the Military Injuries Act, as well as motor liability insurance and accident insurance.

In addition to statutory pension insurance, there are also voluntary, private pension insurance schemes that complement the statutory scheme. In Finland, voluntary pension insurance plays a rather small role.

A pensioner’s income in various countries typically consists of several sources. The basic pension is often supplemented by labour-market-based supplementary pensions paid by a particular sector or employer. These are often based on agreements between trade unions and employers. The Finnish practice of offering the total pension from a single scheme is exceptional from an international perspective.

Both the earnings-related system and the national pension scheme include benefits for old age, 100% disability and the death of a family member. The earnings-related pension system also includes a partial disability pension and a partial old-age pension.

Earnings-related pension as the primary benefit

Statutory earnings-related pension insurance covers virtually all employees over the age of 17 and self-employed persons over the age of 18.

The characteristics of the earnings-related pension system are compulsory, collective and statutory. The earnings-related pension system consists of several pension laws, the most important of which are the Employees Pensions Act (TyEL) and the Public Sector Pensions Act (JuEL).

The rules for determining the benefits of public and private sector employees have been almost identical since the pension reform of 2005, which simplified the pension system significantly.

Earnings-related pensions represent a defined benefit system in that their size is defined in advance. The total amount of earnings-related pensions affects the level of pension contributions and other necessary financing.

National pension and guarantee pension to secure minimum income

When the earnings-related pension remains small, it is supplemented by the means-tested national pension, and at the minimum level by the guarantee pension. The national pension and the earnings-related pension are coordinated: when the earnings-related pension increases, the share of the national pension in the total pension decreases. When the earnings-related pension exceeds a certain euro-denominated limit, the national pension is no longer paid.

The national pension system was created in the late 1930s, while the earnings-related pension system originated mainly in the early 1960s. The national pension remained an important source of income for pensioners for a long time: back in the mid-1990s, more than 90 per cent of pensioners received a national pension paid by the Social Insurance Institution of Finland (Kela). Since then, the number of pensioners receiving a pension from Kela has decreased, and the number of those receiving an earnings-related pension has increased accordingly.

The criteria for determining the national pension were changed in the late 1990s, when the earnings-related pension reduction was introduced. As a result, the national pension became a minimum pension paid only to those with no or little other pension income. In contrast, the statutory earnings-related pension was raised to serve as the primary security for old age.

This change has naturally contributed to a decrease in the number of Kela’s pensioners. In addition, longer careers and higher wages have led to a situation where, on average, when they begin, earnings-related pensions are higher than before. Thus there is less demand for pensions paid by Kela.

Breakdown of pensioners

An individual pensioner may receive just an earnings-related pension, just a national pension, or both. As already stated, the amount of earnings-related pension a person has accrued affects the payment of pensions by Kela.

The most recent statistics are for 2023. At the end of that year, around 1,567,000 people received a pension based on their working careers, that is, either old-age or disability pension.

- Around one million people received earnings-related pensions alone (67% of pensioners).

- ·Just over 80,000 people (5% of pensioners) received a Kela pension alone.

- Around 444,000 people (28% of pensioners) received both an earnings-related and a Kela pension.

Source: Kela’s Pocket Statistics 2024.

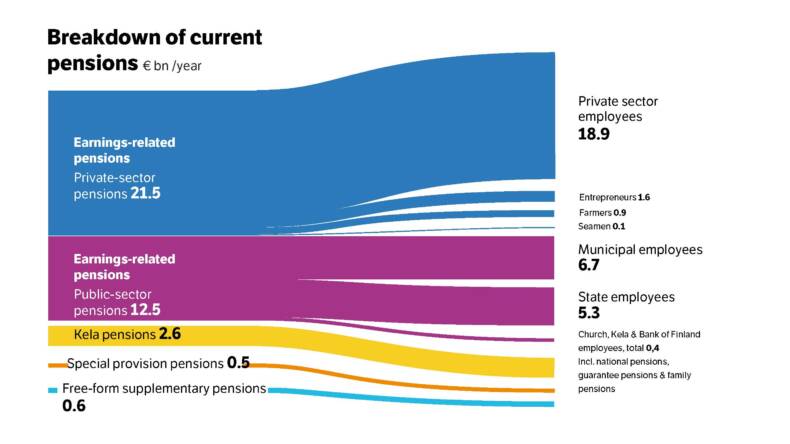

Breakdown of current pensions

The data below are based on pension expenses for 2023.

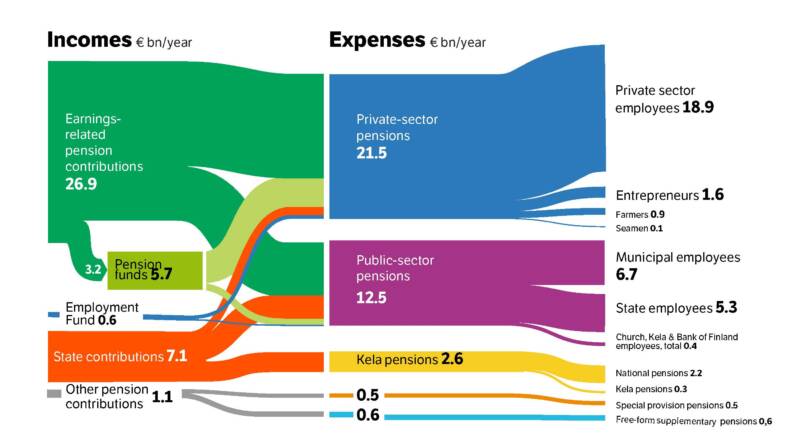

In 2023, pension expenses in Finland totalled EUR 37.8 billion. The vast majority of this total was earnings-related pensions. The figure below illustrates the breakdown of current pensions by pension system:

The largest group of pensioners consisted of retired private-sector employees, who received pensions totalling EUR 21.5 billion. The pension spending on other private-sector pensioner groups was considerably smaller: entrepreneurs’ pensions cost EUR 1.6 billion, farmers’ pensions EUR 0.9 billion and seamen’s pensions EUR 0.1 billion.

Of current public-sector pensions, EUR 6.7 billion was paid to retired municipal employees and EUR 5.3 billion to retired state employees. Pensions to retirees from other public-sector workplaces (Evangelical Lutheran Church, Kela and Bank of Finland employees) totalled EUR 0.4 billion.

Earnings-related pensions form 90% of total pension expenses.

The total of national pensions, guarantee pensions and family pensions paid by Kela was EUR 2.6 billion.

Special provision pensions totalled EUR 0.5 billion and free-form supplementary pensions totalled EUR 0.6 billion.

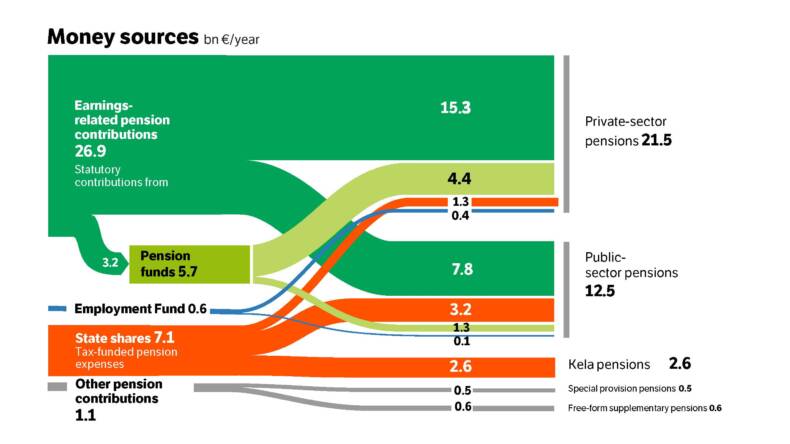

Financing of current pensions

The data below are based on pension expenses for 2023.

Employers, employees, entrepreneurs, the Finnish state and the Employment Fund all fund the pension system overall. In addition, the earnings-related pension system’s pension funds play a significant role in funding current pensions. The figure below illustrates the financing of current pensions in 2023:

The majority of current earnings-related pensions is financed by earnings-related pension contributions, which are paid by private- and public-sector employers, employees and entrepreneurs. Correspondingly, these contributions are only used to fund private- and public-sector earnings-related pensions.

In 2023, a total of EUR 26.9 billion in earnings-related pension contributions was collected. Of this total, EUR 15.3 billion was used to pay private-sector earnings-related pensions and EUR 7.8 billion was used to pay public-sector earnings-related pensions. By contrast, EUR 3.2 billion was transferred to pension funds to finance future pensions.

Pension funds were used to fund current pensions in 2023 to a total of EUR 5.7 billion. Of that amount, EUR 4.4 billion was spent on private-sector earnings-related pensions and EUR 1.3 billion on public-sector earnings-related pensions.

The Employment Fund contributed EUR 0.6 billion to the financing of pensions. The payments by the Employment Fund are used to fund earnings-related pensions earned on the basis of benefits accrued in earnings-related unemployment, training periods and job alternation leave periods.

The state’s share of current pension was EUR 7.1 billion. Of this sum, EUR 2.6 billion was used to pay Kela pensions, which are funded solely by the state.

The state contributed EUR 3.2 billion to public-sector earnings-related pensions. The state is a large employer with 82,000 employees (as of 2023), which pays earnings-related pension contributions as an employer and thus funds its employees’ earnings-related pensions. Some of the state’s share comes from the State Pension Fund and some from the state’s other budgetary funds.

The state contributes around EUR 1.3 billion to private-sector earnings-related pensions. In practice, this means the state contributes to the funding of entrepreneurs’, farmers’ and seamen’s earnings-related pensions. The state’s contribution to entrepreneurs’ earnings-related pensions in 2023 was EUR 485 million, to farmers’ earnings-related pensions – EUR 791 million, and to seamen’s pension – EUR 63 million.

In addition, the state compensates pension providers for the pensions they pay that people have accrued when caring for the under-3s and while studying.

Other pension contributions include the EUR 0.5 billion share of special provision pensions. In addition, other contributions include free-form supplementary pension payments (EUR 0.6 billion), which are contributions made by employers and employees who have taken out voluntary pension insurance.

Total income and expenses of entire pension system

The above incomes and expenses of the entire pension system may also be reviewed in the summary figure below: