Market shares of pension providers

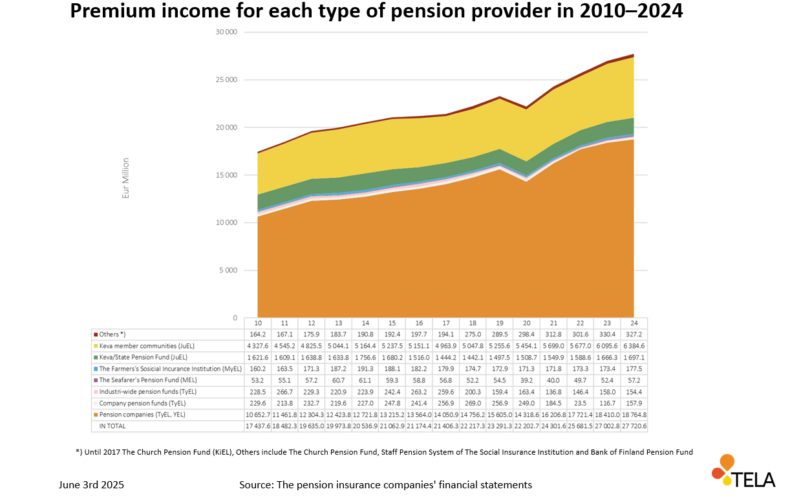

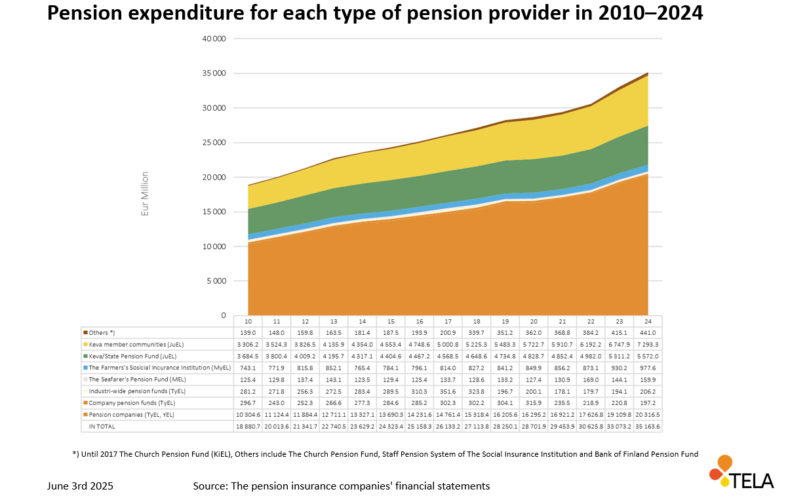

On the basis of pension providers’ financial statements, we make an annual compilation of the pension providers’ market share data both on the yearly basis and as a time series. The compilation describes the breakdown of premium income and pension expenditure for each type of pension provider, and presents the pension insurance companies’ shares of premium income and the people insured under the Employees Pensions Act (TyEL) and the Self-Employed Persons’ Pensions Act (YEL).

Content of this page

Market shares in 2024

Breakdown of premium income

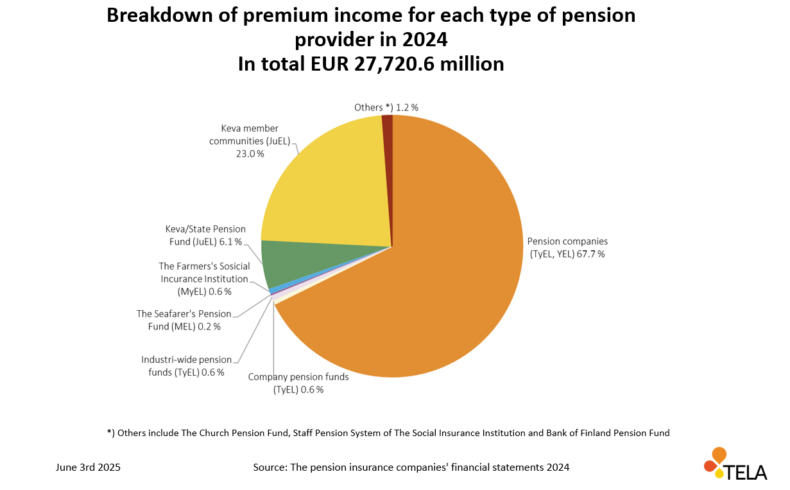

Premium income refers to income collected from employers, employees and self-employed people as pension contributions. Premium income does not include State Budget contributions to earnings-related pensions paid to self-employed people, seafarers and farmers. Nor does premium income include earnings-related pension contributions paid by the State as an employer from the State Budget.

In 2024, the total premium income of authorized pension providers was approximately EUR 27.7billion. The sum was distributed by pension provider type as follows:

The group Other includes the Central Church Fund, the pension fund for the employees of Kela and the pension fund of the Bank of Finland.

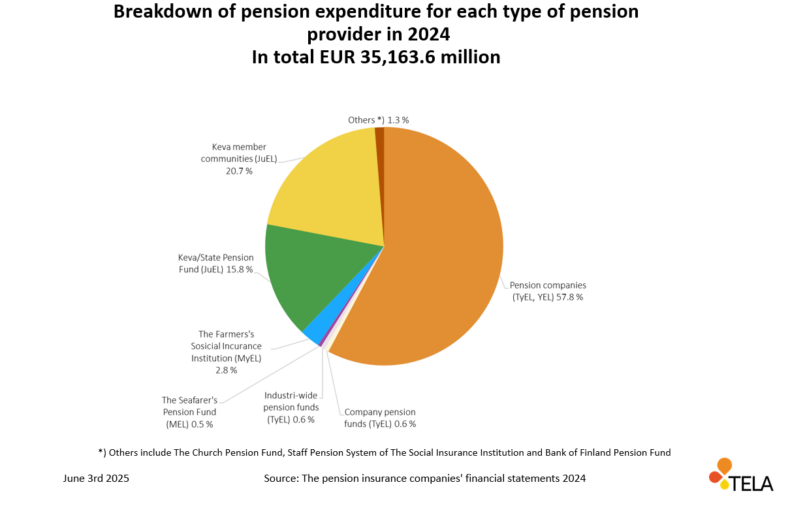

Share of pensions paid

The amount of pensions paid in the entire earnings-related pension system in 2024 totalled approximately 35.2 billion euros. The shares between the different types of pension providers were distributed as follows:

The group Other includes the Central Church Fund, the pension fund for the employees of Kela and the pension fund of the Bank of Finland.

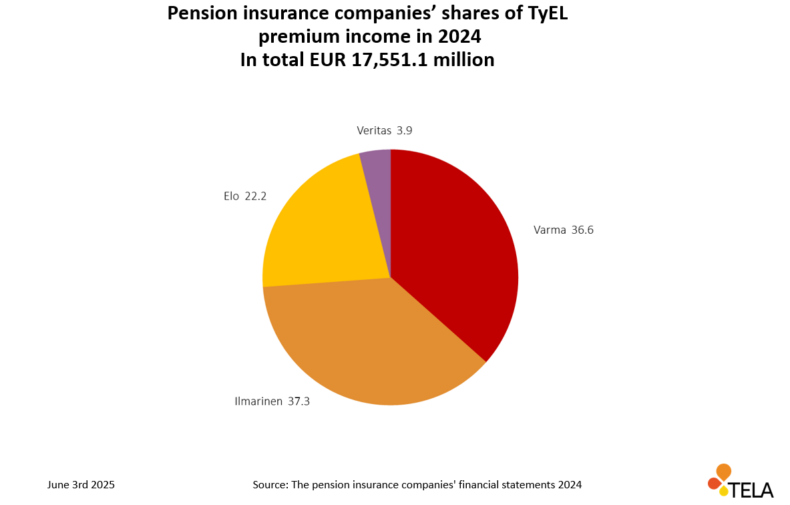

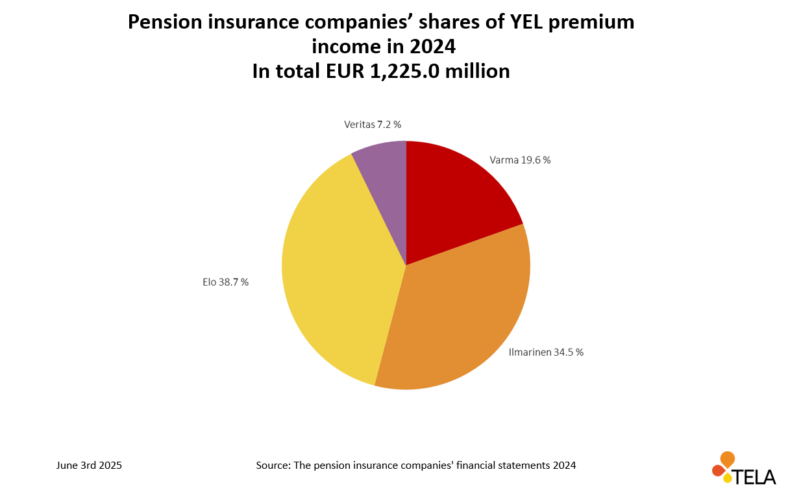

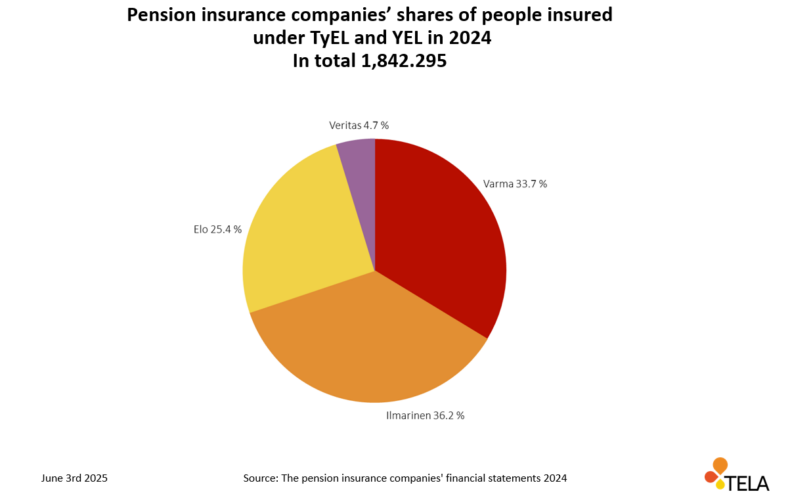

Shares of pension insurance companies of TyEL and YEL premium income and of the insured

At present, there are four pension insurance companies operating in the private sector. All companies offer earnings-related pension insurance for both employees (TyEL) and self-employed persons (YEL).

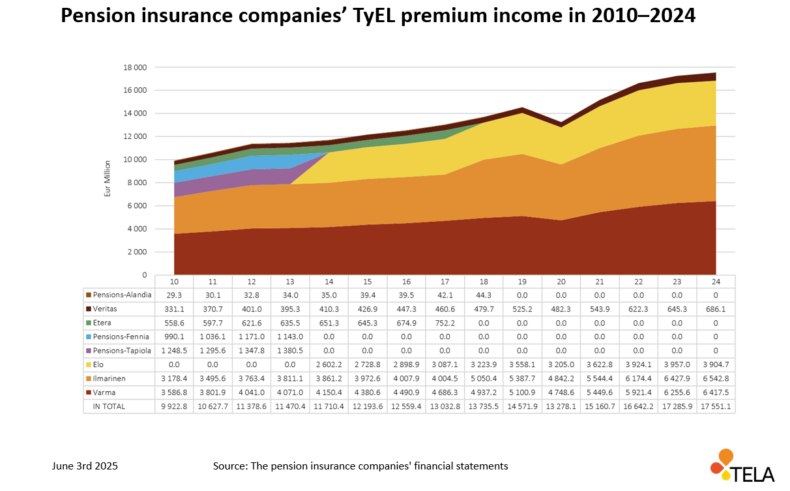

The TyEL premium income for private-sector employees in 2024 totalled approximately EUR 17.6 billion. The TyEL premium income was divided between the pension insurance companies as follows:

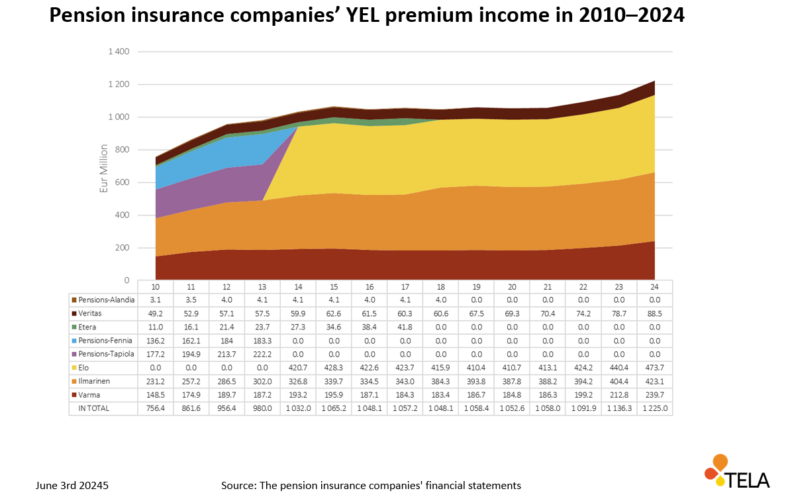

The YEL premium income for self-employed persons in 2024 totalled slightly over one billion euros. The YEL premium income was divided between the pension insurance companies as follows:

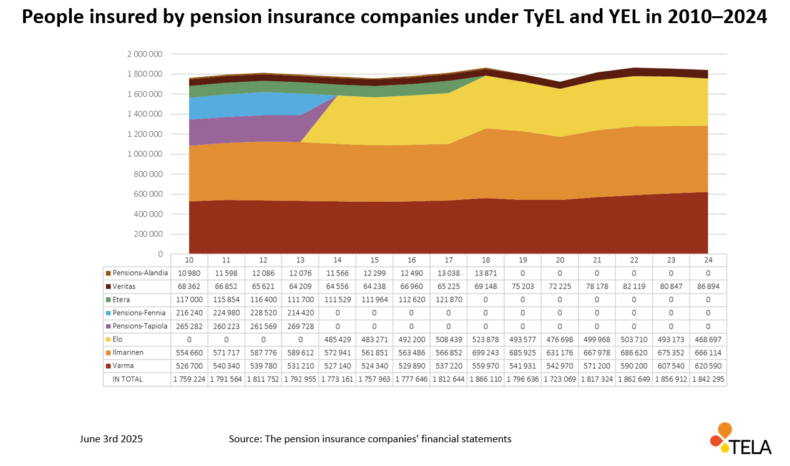

In 2024, TyEL-insured employees and self-employed persons who had taken out YEL insurance totalled about 1.8 million. The insured were divided between the pension insurance companies as follows:

Development of market shares

Our time series graphs of pension providers’ market shares start with the year 2010. As concerns premium income, the graphs show, among other things, the changes that have taken place in the field: for example, the premium income of company pension funds shrank significantly between 2010 and 2019, while the number of pension funds decreased. Correspondingly, the premium income of pension insurance companies has increased.

The time series also shows the most recent effects of the 2020 coronavirus pandemic. The amount of premium income decreased by more than EUR 1 billion for two reasons: a decrease in employment because of lay-offs and redundancies, and the temporary reduction in the earnings-related pension contributions that was agreed.

There have also been changes in the number of pension insurance companies over the period described by the time series. The pension insurance companies Pension Fennia and LocalTapiola Pension merged to form Elo Mutual Pension Insurance Company at the beginning of 2014. At the start of 2018, Etera merged with Ilmarinen and at the beginning of 2019, Pensions-Alandia merged with Veritas. Since 2010, the number of pension insurance companies has therefore decreased from seven to four.