Returns by investment type

For pension insurance companies, it is possible to present group-specific descriptions of the long-term average returns on investments by applying a more precise breakdown of investment categories. This page summarizes the companies’ nominal average returns at the overall level and by the main investment category (fixed-income investments, equity investments, real estate investments and other investments).

Content of this page

Calculation of return figures

The figures presented here are based on information describing the breakdown of investment categories, collected on our page Quarterly information by pension provider. All existing pension insurance companies (Elo, Ilmarinen, Varma and Veritas) are included. The mergers that have taken place in the company field have been taken into account in the calculation of the data as follows:

- Group returns prior to 2014 include Elo’s predecessors Pension Fennia and LocalTapiola Pension.

- Group returns prior to 2018 include Etera, which merged with Ilmarinen at the beginning of 2018.

Pension insurance companies’ nominal group averages for returns are presented at the total level and broken down by the main investment categories and sub-categories in the same way as in the information published quarterly.

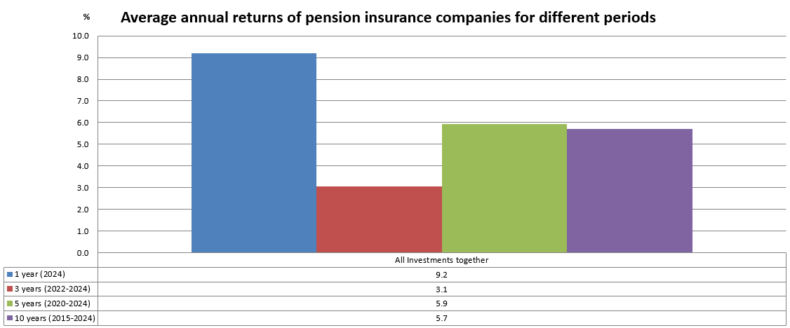

The average group-specific returns on investments are calculated for periods of different durations: 1, 3, 5 and 10 years. The annual return figures are capital-weighted returns (MWR). Through the calculation of geometric averages, these annual return figures have yielded the average annual return figures for longer periods of time (TWR).

Average annual investment returns of pension insurance companies

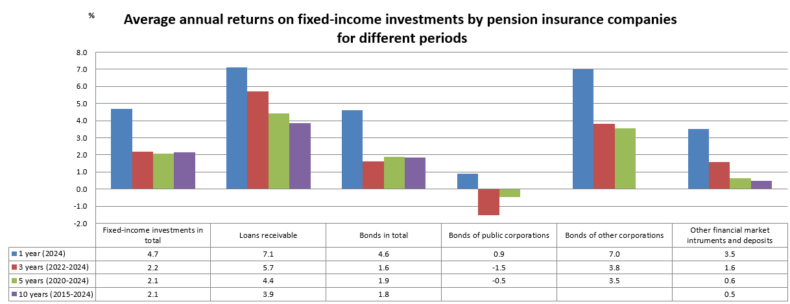

Returns on fixed-income investments

Fixed income investments are the primary risk balancing asset class in pension investment portfolios. Typical fixed income instruments are bonds issued by public sector issuers, such as government bonds and bonds of sub-sovereign issuers. The expected return profile for bonds is above cash but below equity investments. Corporate bonds are an additional, slightly riskier segment within fixed income. Corporate bonds are broadly divided into two categories, investment grade and high yield, depending on the issuer’s credit rating. Other financial market instruments and deposits include riskier private debt, and low-risk money market instruments and bank deposits where returns are close to cash.

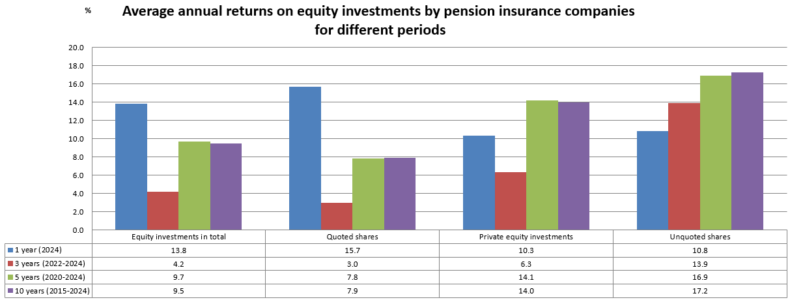

Returns on equity investments

Equity investments comprise two main categories – liquid listed shares and less liquid private equity and unlisted shares. Private equity investments and unlisted equities provide a more stable return during times when exchange listed market values fluctuate sharply in the short term. Hence private equity and unlisted equity investments stabilize pension investment portfolios during market turbulence.

The impact of listed shares on the total return on equity investments over the past decade is significant, as listed shares have accounted for approximately 80 percent of all equity investments in the employment pension companies’ portfolios. The effect of listed shares on the total return is also significant, as listed shares have accounted for 30–40 percent of all investments over the past ten years.

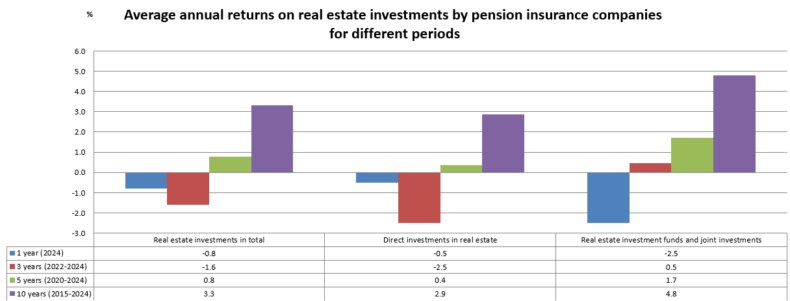

Returns on real estate investments

Real estate comprises investments in residential or commercial properties. Real estate exposure is obtained as either direct investment in property or indirect through mutual funds or publicly or privately held companies. Return and risk profiles of real estate investments typically lie somewhere between fixed income and equity investments. Over the past twenty years, real estate investments in pension portfolios have yielded an average nominal return of slightly above five percent.

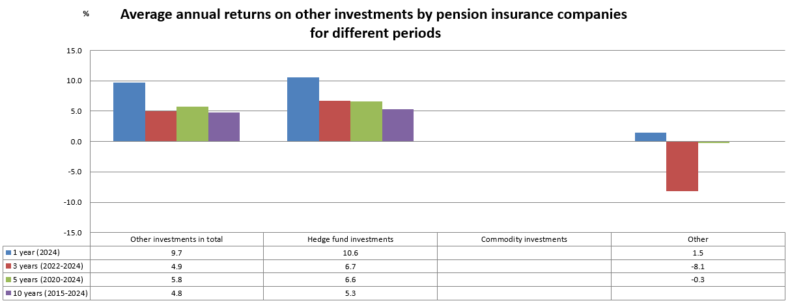

Returns on other investments

Other investments comprise primarily alternative investments such as hedge funds, which complement the traditional asset classes. Hedge funds have become increasingly common in pension investment portfolios since early 2000s. During the years other investments have provided a relatively stable annual nominal return of slightly over six per cent, even though bigger annual fluctuations might happen. Return profiles of hedge funds vary greatly but lie generally somewhere between fixed income and equity investments. A distinctive feature of hedge funds is that the target returns are often achieved with lower volatility or less cross-asset correlation than the traditional asset classes.