Importance of investment

Investment activities and the returns derived from them play a major role in the Finnish earnings-related pension system. Some of the earnings-related pension contributions collected each year are placed into funds for future years, and the assets funded are invested on the financial markets. The aim of investments is to reduce pension contributions collected both at present and in the future.

Investing as part of the pension system from the beginning

When the pension system for private-sector employees was created in the early 1960s, it was based on partial funding. In consequence, some of the pension contributions collected each year are put into a fund for future pensions, while the remainder is used to finance the pensions paid in that particular year. This procedure has been followed since the beginning of the system.

Correspondingly, some of the earnings-related pensions paid each year are covered by previously funded assets and their returns.

The public sector also has funds of the buffer type. These were introduced mainly at the turn of the 1990s. In the past, some of the annual pension contributions were collected into these funds, to prepare for future pension expenses. During the 2010s, the municipal sector and the State Pension Fund have taken steps to dismantle the buffer funds and to use the assets for the payment of pensions.

Investing reduces the pension contribution

Earnings-related pension assets are placed into funds and the funded assets are invested in order to reduce the earnings-related pension contributions collected from employees and employers — now and in the future. When part of the financing of pensions can be covered by the funds and the investment returns received from them, the earnings-related pension contribution can be kept at a lower level than the pension expenditure would require.

The return on investments has no effect on the pensions paid, and any poor investments do not reduce earnings-related pensions. Investment returns only affect the amount of earnings-related pension contributions collected from employers and employees in order to fund pensions.

Without investment assets and their returns, around EUR 1.2 billion more should have been collected for earnings-related pensions in the private sector year 2023. Wages should therefore be subject to pension contributions 1.5 percentage points higher than those actually collected.

Thus, earnings-related pension assets are invested in order to secure earnings-related pensions at the lowest possible level of pension contributions. This also supports employment, as earnings-related pension contributions constitute a part of the indirect employment costs.

Interest-on-interest for better returns

The term “interest-on-interest” used in connection with saving also applies to the investment of pension assets. Over time, the investments yield returns, both on the principal initially invested and on the returns of previous years. As a result, returns may increase even if no new capital is invested. This is known as the interest-on-interest phenomenon.

Since investments in the earnings-related pension system are made over a time span of decades, the interest-on-interest phenomenon plays a major role in the generation of returns.

Time horizon extends over decades

The time horizon of earnings-related pension investment is not a quarter or a year, but extends over a longer term: years, even decades. Therefore, investment returns should also be assessed over a longer period of time.

One poorly performing quarter, or even an entire year, is not fateful to the sustainability of the system. Returns generated within a short period of time reveal more about the market conditions during that period than about the sustainability and applicability of pension providers’ investment plans.

The returns on earnings-related pension investments vary from year to year — sometimes even widely. However, most returns have been positive: there have been only four years of negative returns during the last 20 years (between 2005 and 2024). They are also a facet of the nature of investment markets, especially in equities.

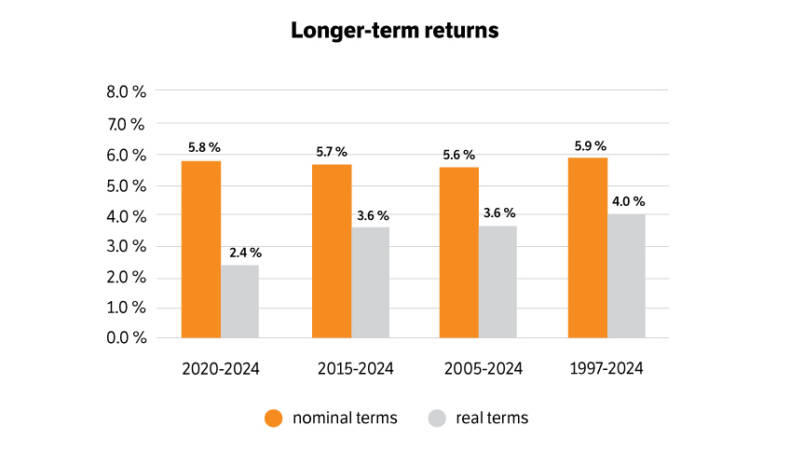

Comparable data on earnings-related pension assets and their returns have been available since 1997. If the returns on investments are examined from the start of 1997 to the end of 2024, the annual mean return of the private sector has been 5.9 per cent in nominal terms. Elimination of the effect of inflation, i.e. the rise in consumer prices, from this nominal return yields the annual real return, which was 4.0 per cent for the same period.

Correspondingly, for the last ten years (2015–2024), the average annual return has been 5.7 per cent in nominal terms and 3.6 per cent in real terms. For the last five years (2020–2024), the average return has been 5.8 per cent in nominal terms and 2.4 per cent in real terms.

The Finnish Centre for Pensions makes long-term calculations on the development of earnings-related pensions and the sustainability of the pension system. Responding to weak investment prospects and, especially the low interest rates, in calculations published in autumn 2016, the Finnish Centre for Pensions lowered the projected real return used in the sustainability calculations of the earnings-related pension system from 3.5 per cent to 3.0 per cent for the next ten years. In calculations published in spring 2019, the real return assumption was reduced to 2.5 per cent for the years 2019–2028, after which the assumption will return to 3.5 per cent. In the most recent calculations published in October 2022, the Finnish Centre for Pensions continued the 2.5 per cent real return assumption until 2031.

If the above long-term returns (from the beginning of 1997) are compared against this return assumption, the figure has been exceeded from the viewpoint of both the 2.5% and 3.5% assumptions.

It can roughly be said that if the long-term yield generated by funds corresponds to the average return assumption, no change to the present pension contribution plan need be made. If the long-term average return of the funds falls by half a percentage point, pension contributions must be raised by one percentage point, and vice versa.

Investment returns – increasingly important in the future

Even today, some earnings-related pensions are covered by pension funds and their investment returns. As of 2013, the pension contributions collected have not been sufficient to cover the earnings-related pensions paid in the private sector. A similar turnaround took place in the public sector in 2017, after which pension expenditure has exceeded premium income.

The difference between pension expenditure and premium income is specifically covered by funds and their investment income: in 2023, for example, the sum of roughly about EUR 5.7 billion derived from pension funds was spent on pensions (in the private and public sectors combined).

Increasingly many pension-euros will be paid from funds when pension expenditure rises higher than the income collected year by year through premium income. This has been one of the reasons for creating pension funds.

The sustainability calculations of the earnings-related pension system have taken into account current funds and the proceeds obtained from them.