Circulation of pension money

Most of the pension contributions collected yearly are used to pay the pensions of people who are currently on pension. The earnings-related pension system in the private sector, however, follows the principle of partial funding. This means that some of the pension contributions collected each year are put into funds and invested to help pay the pensions in the coming years.

The following figures illustrate the circulation of earnings-related pension money. Since the private and public sectors apply different principles to the accumulation of funds, there are two separate circulation models. The sums refer to earnings-related pensions in 2024 and are based on financial statement data.

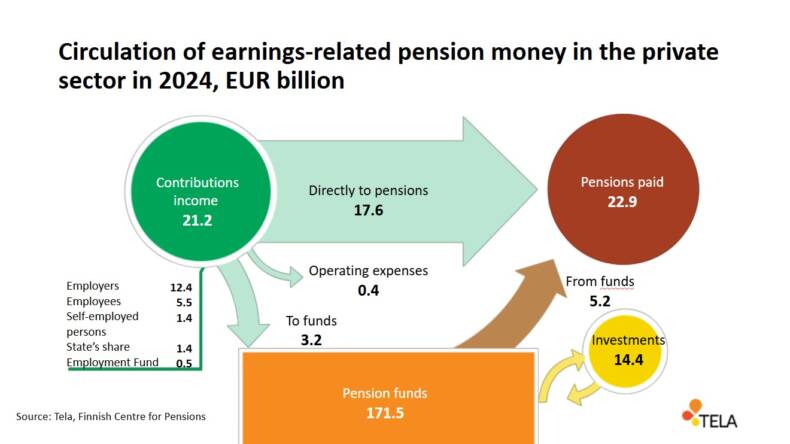

Circulation of earnings-related pension money in the private sector in 2024, EUR billion

Contributions collected

In 2024, the earnings-related pension contributions and the State’s shares collected in the private sector totalled EUR 21.2 billion. This sum included

- the earnings-related pension contributions collected from both employers and employees

- the contributions paid by self-employed persons

- the State’s share of pensions paid to self-employed persons, farmers and seafarers

- the share paid by the Employment Fund, which is used to cover pensions accrued while receiving earnings-related unemployment allowance.

Most of the contributions collected, or EUR 17.6 billion, was used directly for earnings-related pensions paid in 2024.

In all, EUR 3.2 billion of the contributions was transferred to funds. If the sum put into funds is compared against the earnings-related pension contributions collected from employers and employees (in total EUR 17,9 billion), the sum transferred to funds is slightly less than a fifth of the total.

A small percentage of the contributions collected, EUR 0.4 billion, was used towards the operating expenses of the authorized pension providers. This covers, for instance, the costs arising from the calculation and granting of earnings-related pensions and all operating expenses incurred by the authorized pension providers in the private sector.

Change in investment assets

The amount of assets is affected by both investment returns and the use of funds to pay pensions.

The total assets are reduced by the sum that the total for pensions paid out of funds (5.2 billion during 2024) exceeds the amount of pension contributions put simultaneously into funds (3.2 billion during 2024). The impact of investment returns on the amount of investment assets is even greater. Investments yield cash returns, i.e. dividends, interest and rental income. In addition, the values of investments change depending on the market conditions.

Investment returns in the private sector was 14.4 billion during 2024. Assets thus increased by EUR 12.4 billion.

At the end of 2024, the earnings-related pension assets accumulated in the private sector totalled EUR 171,5 billion. This amount of pension assets refers to the net investment assets, which we also use in our statistics on investment assets.

Pensions paid

The earnings-related pensions paid in the private sector in 2024 totalled EUR 22,9 billion. EUR 17.6 billion of the earnings-related pension contributions collected in the same year were used to finance these pensions. The remainder, EUR 5.2 billion, was taken from funds.

Since 2013, the earnings-related pension expenditure in the private sector has been greater than the income obtained from the pensions contributions collected. The difference is covered by using the investment funds and returns from investments. Thus, investments play an important role in the payment of earnings-related pensions. This importance will increase further in the coming decades along with the growth in earnings-related pension expenditure.

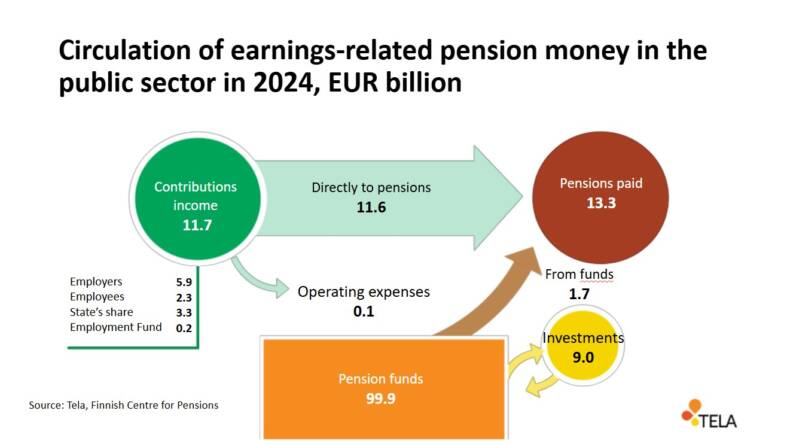

Circulation of earnings-related pension money in the public sector in 2024, EUR billion

Contributions collected

In the public sector (municipalities, the State, the Evangelical Lutheran Church, Kela, the Bank of Finland), earnings-related pension contributions and the State’s shares totalled EUR 11.7 billion in 2024. This sum included

- the earnings-related pension contributions collected from both employers and employees

- the contributions collected from the State in its role as an employer

- other financing provided by the State

- the share paid by the Employment Fund, which is used to cover pensions accrued while receiving earnings-related unemployment allowance.

Most of the contributions collected, or EUR 11.6 billion, was used directly to pay for earnings-related pensions in the public sector in 2024.

A small percentage of the contributions collected, EUR 0.1 billion, was used towards the operating expenses of the authorized pension providers in the public sector. This covers, for instance, the costs arising from the calculation and granting of earnings-related pensions and all operating expenses incurred by the authorized pension providers in the public sector.

Since 2017, assets have no longer been transferred to funds in the public sector. On the contrary, the funds are being disbursed for the payment of pensions.

Change in investment assets

The amount of assets is affected by both investment returns and the use of funds to pay pensions.

The total assets are reduced by the sum for pensions paid out of funds. The impact of investment returns on the amount of investment assets is even greater. Investments yield cash returns, i.e. dividends, interest and rental income. In addition, the values of investments change depending on the market conditions.

Investment returns in the public sector was 9.0 billion during 2024. EUR 1.7 billion was taken from funds. Assets thus increased by EUR 7.3 billion.

At the end of 2024, the earnings-related pension funds in the public sector had a balance of EUR 99.9 billion.

Pensions paid

The total amount of earnings-related pensions paid in the public sector in 2024 came to EUR 13.3 billion. This was largely covered by contributions collected in the same year, which accounted for EUR 11.6 billion. EUR 1.7 billion was taken from funds.

Since 2017, the amount of pensions paid in the public sector have been greater than the amount of earnings-related pension contributions. The difference is covered by investment assets and their returns.

Figures as PDF file and previous years

The figures can be downloaded as a PDF file using the following link: