Time series graphs on stock market holdings

The enclosed time series graphs enable us to examine Finnish pension insurers’ holdings on the stock exchange from 2004 onwards. The graphs make a distinction between the whole earnings-related pension sector and pension insurance companies.

Content of this page

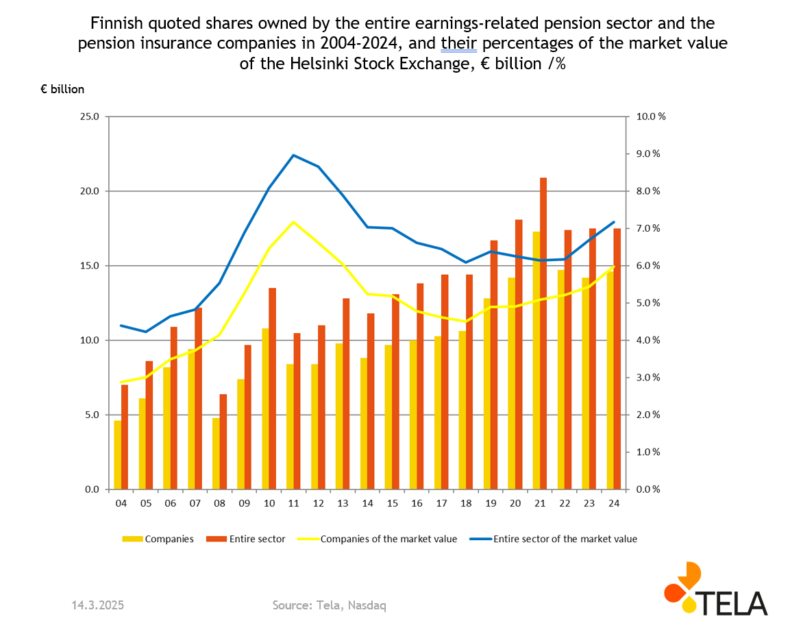

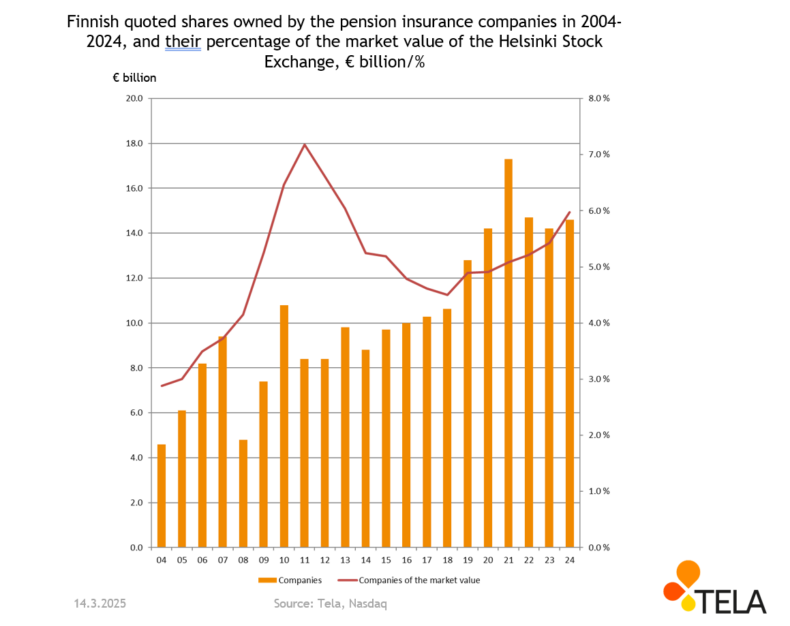

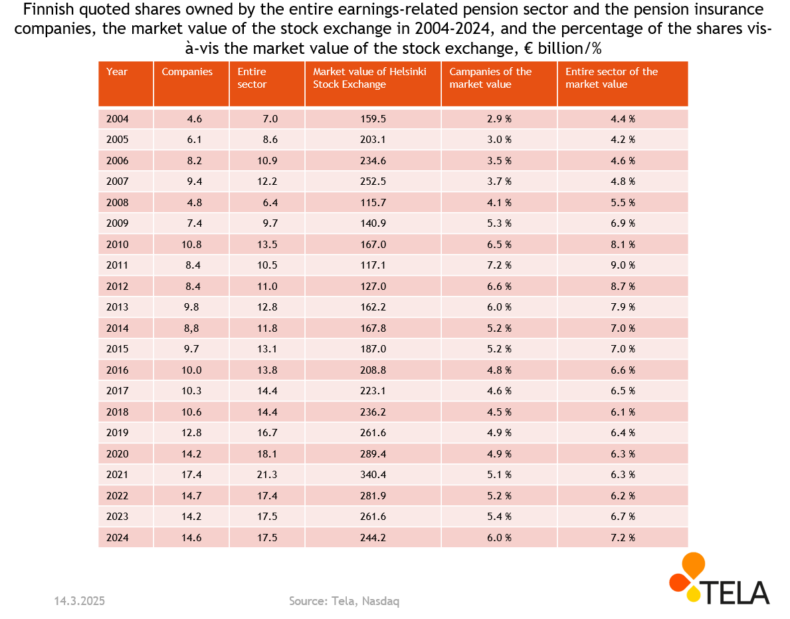

Finnish quoted shares owned by the pension sector

At the end of 2023, the value of the Finnish quoted shares owned by the entire earnings-related pension sector totalled EUR 17.5 billion.

Pension insurance companies held 81.1 per cent, or EUR 14.2 billion, of these holdings. The remaining 18.9 per cent (EUR 3.3 billion) were owned by public-sector pension insurers, company pension funds and industry-wide pension funds, and by specialized pension providers (Farmers’ Social Insurance Institution, Seafarers’ Pension Fund).

The companies and the whole sector followed largely parallel trends between the years 2004 and 2024.

Changes over the years

During the early 2000s, the pension sector’s holdings of domestic quoted shares increased steadily, thanks to a favourable market trend and additional purchases. The impact of the global financial crisis is evident in 2008, when the market value of the pension sector’s domestic holdings plummeted following the fall in share prices.

It wasn’t until 2021 when the market value of the Helsinki Stock Exchange fully recovered from the 2008 global financial crisis. Hence, similarly the earnings-related pension sector’s share of the Helsinki Stock Exchange’s market value reached a new record during 2021. This was not only due to a rise in total pension assets but also a longer term, positive trend on the financial market.

Following the global financial crisis, the pension sector’s share continued to grow until 2011 when the pension sector owned nearly ten percent of all shares listed at the Helsinki Stock Exchange. During the past decade, the pension sector’s relative share has decreased as the assets have been further diversified to the global markets.

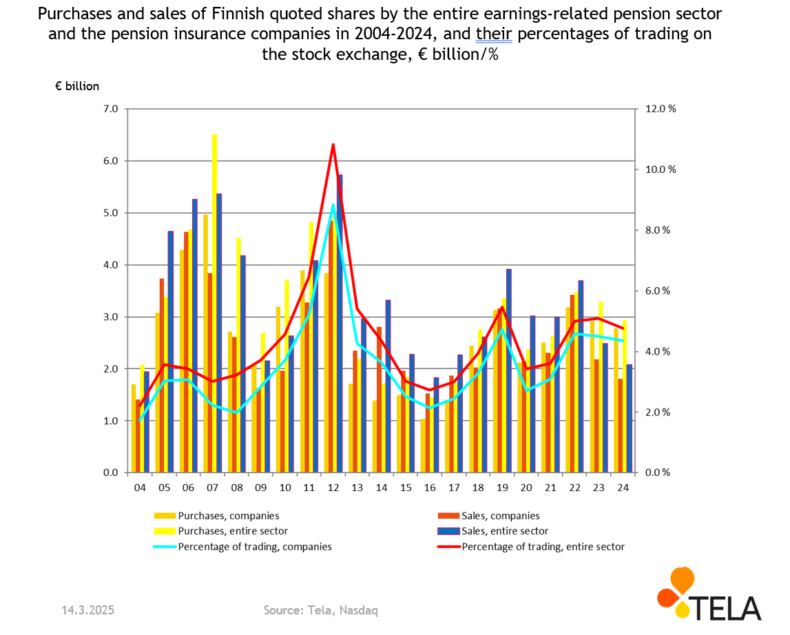

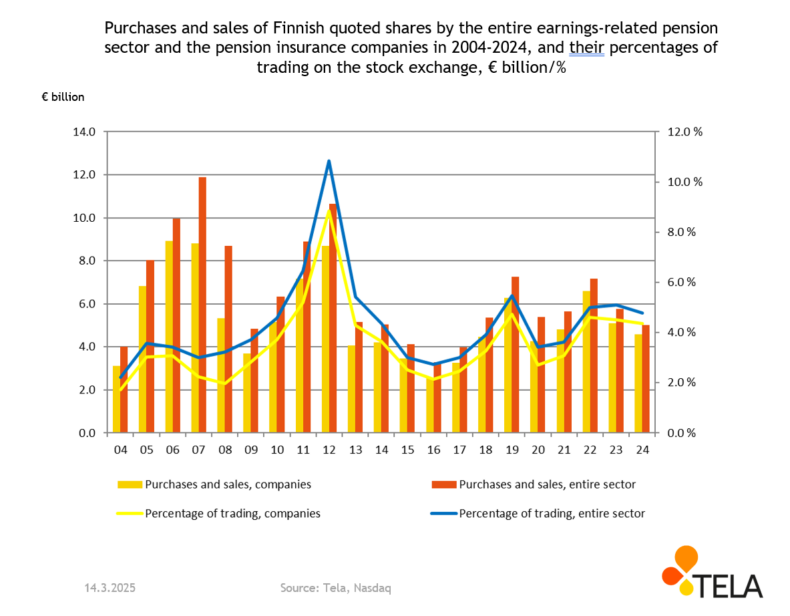

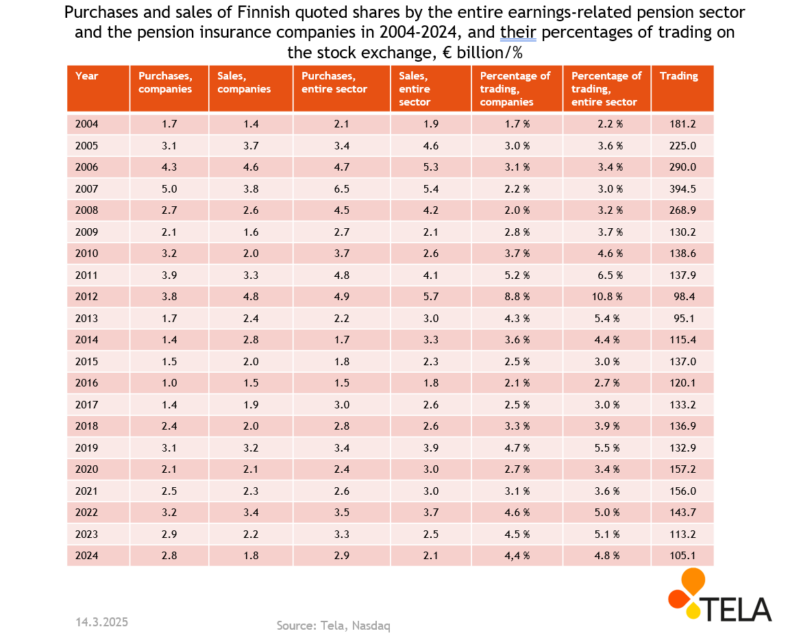

Purchases and sales of Finnish quoted shares by the pension sector

The pension sector’s annual trading volume in quoted Finnish shares, i.e. the sum of all sales and purchases, peaked before the global financial crisis during the first decade of 2000s. The financial crisis in 2008 also brought a halt to this trend. After 2009, trading picked up again and, in the early 2010s, returned to the level that prevailed before the financial crisis.

However, trading on the Helsinki Stock Exchange has not returned to the level preceding the financial crisis; instead, it has remained at a considerably lower level: The average trading in 2009–2012 is slightly under half of the average trading in 2004–2008. Owing to this trend, the pension sector’s share of trading on the Helsinki Stock Exchange has risen after the financial crisis.

Finnish quoted shares owned by the pension sector and the market value of the stock exchange

Time series as a PDF file

We update the graphs once a year during March. The graphs can also be downloaded as a PDF file.